Wydarzenia w SPECTIS

Aktualności

Contractors’ limited construction capacity to block booming investments in the Polish railway sector?

11 mar 2024

Aggregate capital expenditure on railway infrastructure that is planned for 2024-2030 as part of several public investment programmes is nearly PLN 250bn. This is twice as much as the railway construction sector’s actual capacity. In view of such a vast disparity, we can expect that the official plans will need to be revised and verified, resulting in discontinuing some of the projects planned or extending their duration. In fact, realigning the ambitious investment plans to the actual construction capacity of the relevant entities will likely be the outcome of these two approaches.

According to the recent report from Spectis - "Railway construction in Poland 2024-2029" the combined funds stipulated in just three main railway sector schemes designed by the government for railway infrastructure in 2024-2030 (i.e. the National Railway Scheme, the second stage of the CPK investment scheme, and the Railway Infrastructure Maintenance Scheme) is over PLN 200bn. Adding less sizeable initiatives (Railway Plus, Railway Station Investment Scheme), railway projects funded through the National Recovery Scheme, and the local authorities’ capital expenditure plans for tramway infrastructure, the total expenditure planned on rail infrastructure in 2024-2030 is nearly PLN 250bn, which is equal to PLN 35bn annually, that is twice as much as the railway construction sector’s capacity.

In the latest report we reviewed top 120 railway construction companies (defined as companies specialised in construction of railways, tramways, electrical traction systems, rail traffic control, signalling systems, and railway civil engineering structures). Whereas their combined revenue totalled PLN 38bn in 2022, a mere 36% of that amount (just under PLN 14bn) was generated through railway projects.

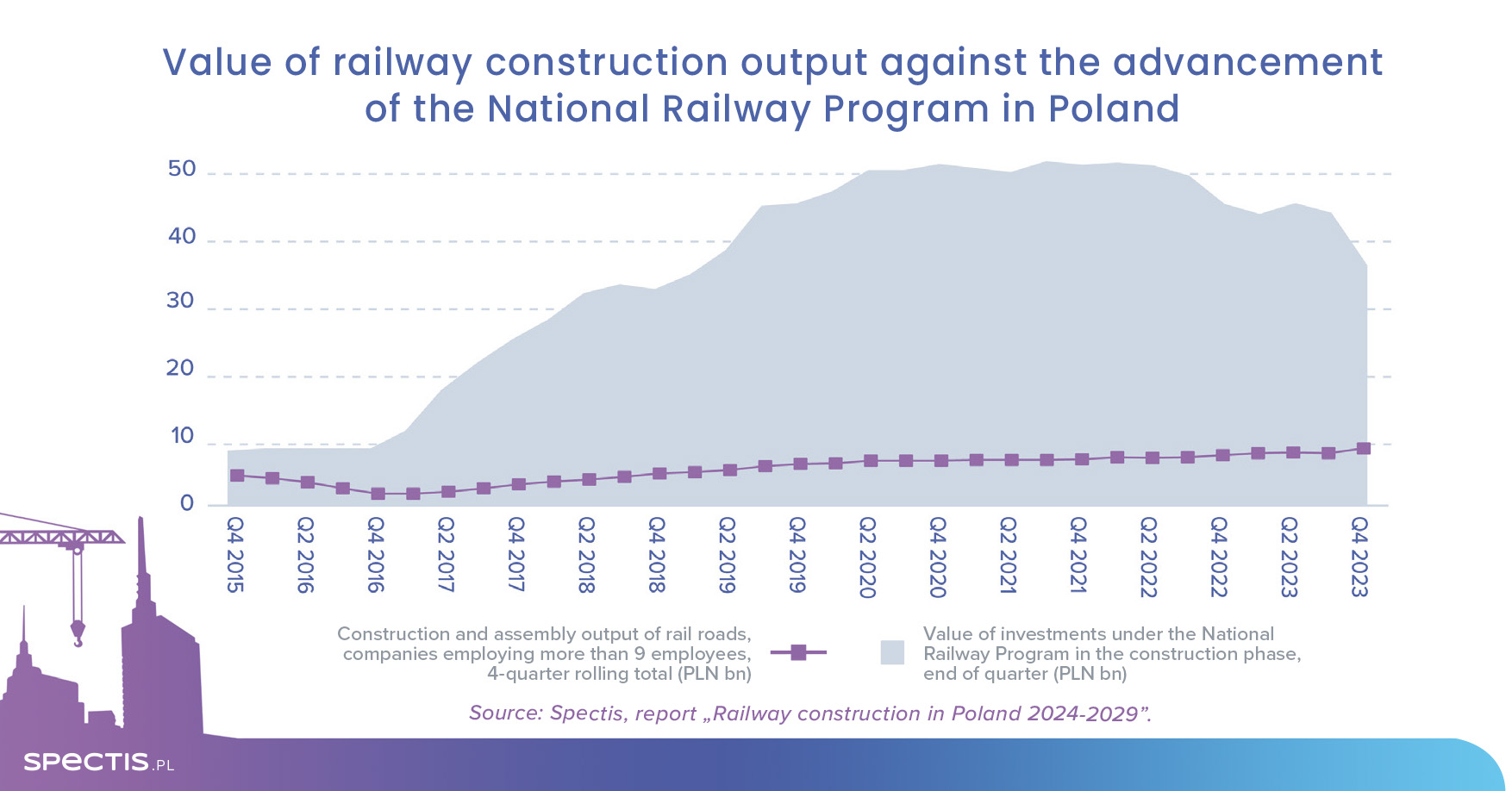

A review of the implementation of projects comprising the National Railway Scheme over the past decade best indicates that the construction companies have been facing severe challenges to grow their construction capacity and speed up ongoing contracts. Although the value of ongoing projects grew six-fold in 2016-2020, construction output generated by construction companies from railway projects rose only three-fold between 2016 and 2022. It shows that construction companies will not be able to adapt their production capacity to the sharp increase in the number of new orders immediately.

Steady stream of new orders is key to success

What construction companies need so as to secure sustainable growth of production capacity is a steady stream of new contracts that are spread over at least a decade, which was not quite the case in recent years.

Slowdown in PKP PLK’s tendering activity observed in the past years has been reflected in the past several quarters in the aggregate backlog of orders held by the top four railway construction companies (Torpol, Budimex, ZUE, Trakcja), as calculated by Spectis researchers - it was only PLN 6.2bn at the end of 2023, compared with as much as PLN 10bn at the end of 2019. Despite the temporary slowdown in tendering activity, the long-term outlook for the railway construction sector remains promising.

PLN 100bn worth of projects on horizon

The railway report also reviews 270 ongoing projects as well as projects that are likely to be pursued in the coming years. The estimated value of these projects is PLN 127bn, including PLN 30bn (24%) worth of ongoing projects, and projects in the tender, planning or initial concept stages that are valued at a combined PLN 97bn. The sizeable gap between the value of ongoing projects and projects in the planning stage reveals a huge long-term potential for the growth of this branch of the construction industry. The top-ranking regions in terms of the value of railway projects are: Malopolskie, Slaskie, Lodzkie, Mazowieckie, Pomorskie, and Podlaskie. These six voivodships combined account for over 70% of all projects underway and planned. Opolskie, Lubuskie, and Swietokrzyskie are expected to be the regions with the lowest investment activity in the railway segment in the coming years.

Low profit margins a barrier to companies?

Relatively low profitability of the railway construction sector remains its main pain point. In 2017-2022, the average net profit margin for the 120 companies reviewed stood at 3.2%. The profit margin for the whole industry was impacted by financial problems of several major construction companies operating in the sector. An analysis of preliminary financial results posted by major companies indicates that the industry’s net profit margin improved to around 5% in 2023. Notwithstanding that it is still far from impressive.

Request a free sample of the report:

info@spectis.pl