Our articles

Articles

PLN 800bn for nearly thousand large-scale projects in Poland

01 aug 2022

The growth potential of the Polish construction market will remain significant through 2027 (and in the long term) on the back of the necessity to accelerate energy transformation of Polish economy, the continuation of ambitious transport infrastructure projects, the influx of Ukrainian refugees, and the expected trend among companies that previously operated east off the Polish border to move to Poland. A vast majority of projects underway or planned to implemented are located in the six most economically advanced regions, which jointly account for two-thirds of the construction market’s value.

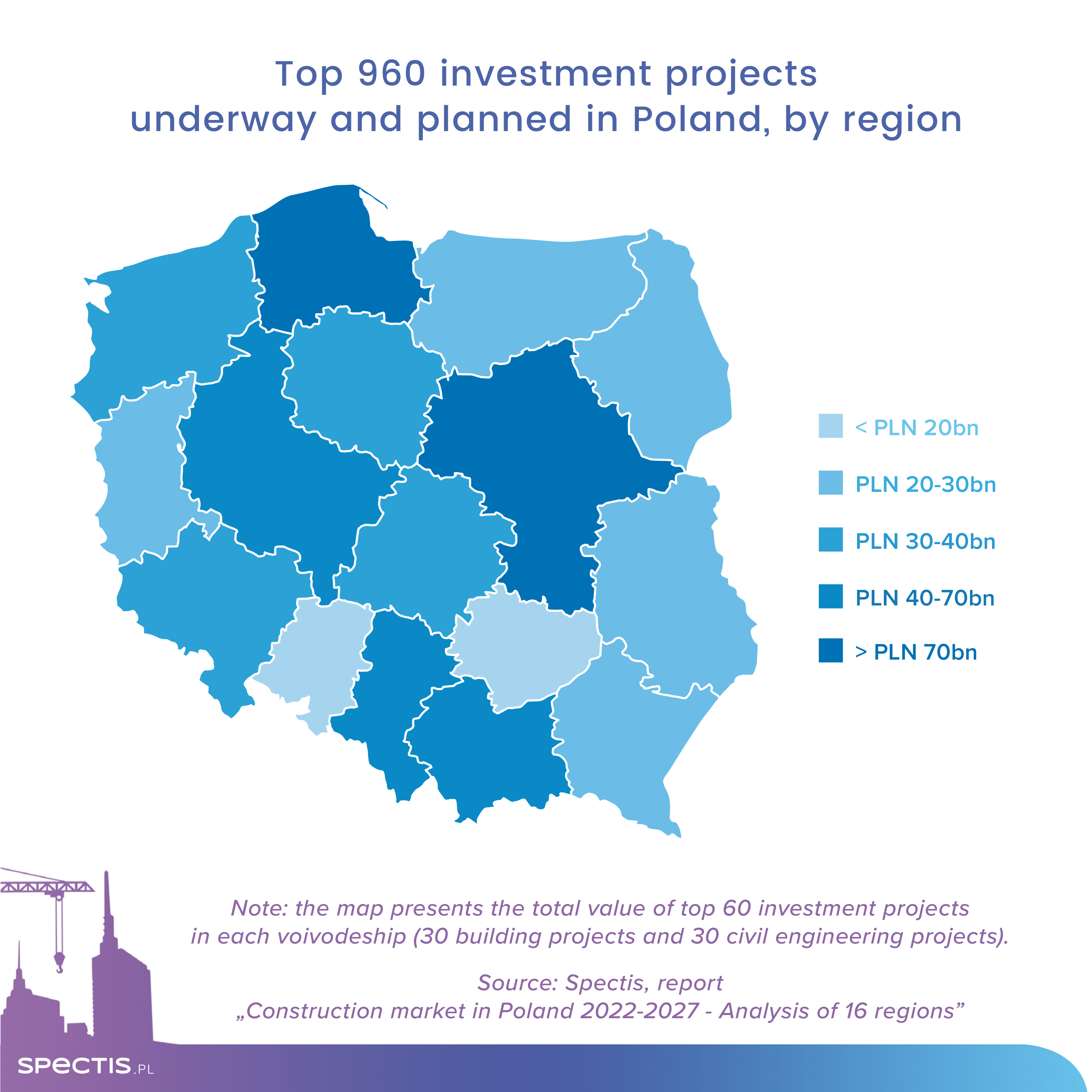

The total value of the 960 largest investment projects underway or planned in the 16 regions of Poland is estimated at around PLN 690bn, according to the findings of the latest report from Spectis, "Construction market in Poland 2022-2027 – an analysis of 16 voivodships". When combined with the planned offshore windfarm projects in the Polish sector of the Baltic Sea, the aggregate value of nearly 1,000 projects is estimated at nearly PLN 800bn.

For the needs of the report, the Spectis team have reviewed a set of almost 1,000 projects that will make the biggest contribution to the future economic developments in the construction markets locally across the country. The study focused on the top 60 projects in each of the voivodships: 30 building construction projects and 30 civil engineering projects. The total value of the flagship projects underway is PLN 140bn, whereas projects in the tender, planning or early concept stage are valued at PLN 550bn.

The value of projects covered in the report amounts to almost PLN 720m per single project on average: the average figure for building structures stands at PLN 334m, and it is over PLN 1.1bn for civil engineering structures. As far as civil engineering projects are concerned, the exponential average value for civil engineering projects has been driven by several mega-projects worth a few dozen billion zlotys. However, projects of that size are typically subject to a serious risk of delay. On top of that, some of the may never be completed at all.

A study of the investment plans indicates that Pomorskie and Mazowieckie are in the lead in terms of project value. The value of the top 60 projects in these regions vastly exceeds PLN 100bn. In Pomorskie, the leading segments will include power and industrial construction, hydro technical construction, railway construction, road construction, and residential construction. As far as Mazowieckie is concerned, the largest numbers of projects are planned in the following segments: power and industrial construction, road construction, hydro-technical construction, railway construction, and industrial and warehouse construction.

Wielkopolskie is ranked in the third position with the value of the projects amounting to over PLN 60bn, including over PLN 50bn contributed by civil engineering projects, mostly power, road, and railway construction projects.

The following positions, in terms of total value of projects, are occupied by Slaskie (PLN 53bn), and Malopolskie (PLN 45bn). Segments in the Silesian region that are expected to witness the most robust construction activity include railway and road construction as well as industrial construction, water structures, and industrial and warehouse buildings. In addition to road, railway and bridge-tunnel projects in Malopolskie, the region will also see robust activity in the segments of offices and public buildings.

Besides civil engineering construction, building construction will remain a major driving engine behind the construction sector’s growth in the regions. As far as non-residential construction is concerned, the largest floor space of projects is planned in Mazowieckie, Wielkopolskie, Slaskie, and Lodzkie (over 2 million m²). Regarding the residential construction segment, the average annual number of flats delivered for use will be around 220,000 in 2022-2027, including 40,000 in Mazowieckie, and over 20,000 in each of Dolnoslaskie, Malopolskie, Pomorskie, and Wielkopolskie. These five regions combined will account for 55% of the entire market. This year’s influx of Ukrainian refugees will be the key driver behind the increased demand for flats (mostly rental flats) in the major urban agglomerations.

Lubuskie, Lodzkie, Malopolskie, and Zachodniopomorskie are the regions with the most balanced proportions between the number of projects underway and projects planned (early concept, design, or tender stage) in both civil engineering and building construction segments. Regions with a prevailing share of projects in the planning stage include Wielkopolskie, Slaskie, Swietokrzyskie, and Podkarpackie.

The most interesting building construction projects in planning, which can have a major effect on an entire region or city, besides the Central Communication Port (Mazowieckie), include: Towarowa 22, and Warszawa Modlin Smart City (Mazowieckie), Dune City (Zachodniopomorskie), Wolne Tory (Wielkopolskie), Nowy Welnowiec, and the Izera electric car plant (Slaskie), Gdynia Centrum, Mlode Miasto, and an offshore wind turbine plant (Pomorskie), the SK Nexilis Electric car battery copper foil plant (Podkarpackie), and a heat pump plant pomp (Lodzkie).

Some spectacular civil engineering projects in the planning stage, other than the Central Communication Port and offshore windfarms in the Baltic Sea, also include two nuclear power plants (Pomorskie, Wielkopolskie), Gdansk Port – Central Port, Gdansk-Warsaw waterway, a copper mine (Lubuskie), the Silesian Canal, the Lodz Fabryczna-Lublinek railway tunnel, the S6 Szczecin Western Bypass, or the extension of the A4 motorway.

Ask for free sample of the report

info@spectis.pl