The outlook for Poland’s construction market is becoming increasingly region-specific. One thing, however, remains unchanged – the scale of planned investments continues to grow. Despite ongoing political and economic uncertainty, strategic infrastructure and energy projects are steadily moving from the planning phase to implementation. Spectis’ regional report highlights which provinces are set to see the highest volume of investment and which segments of the construction sector offer the strongest growth potential.

Total value of key investments continues to grow

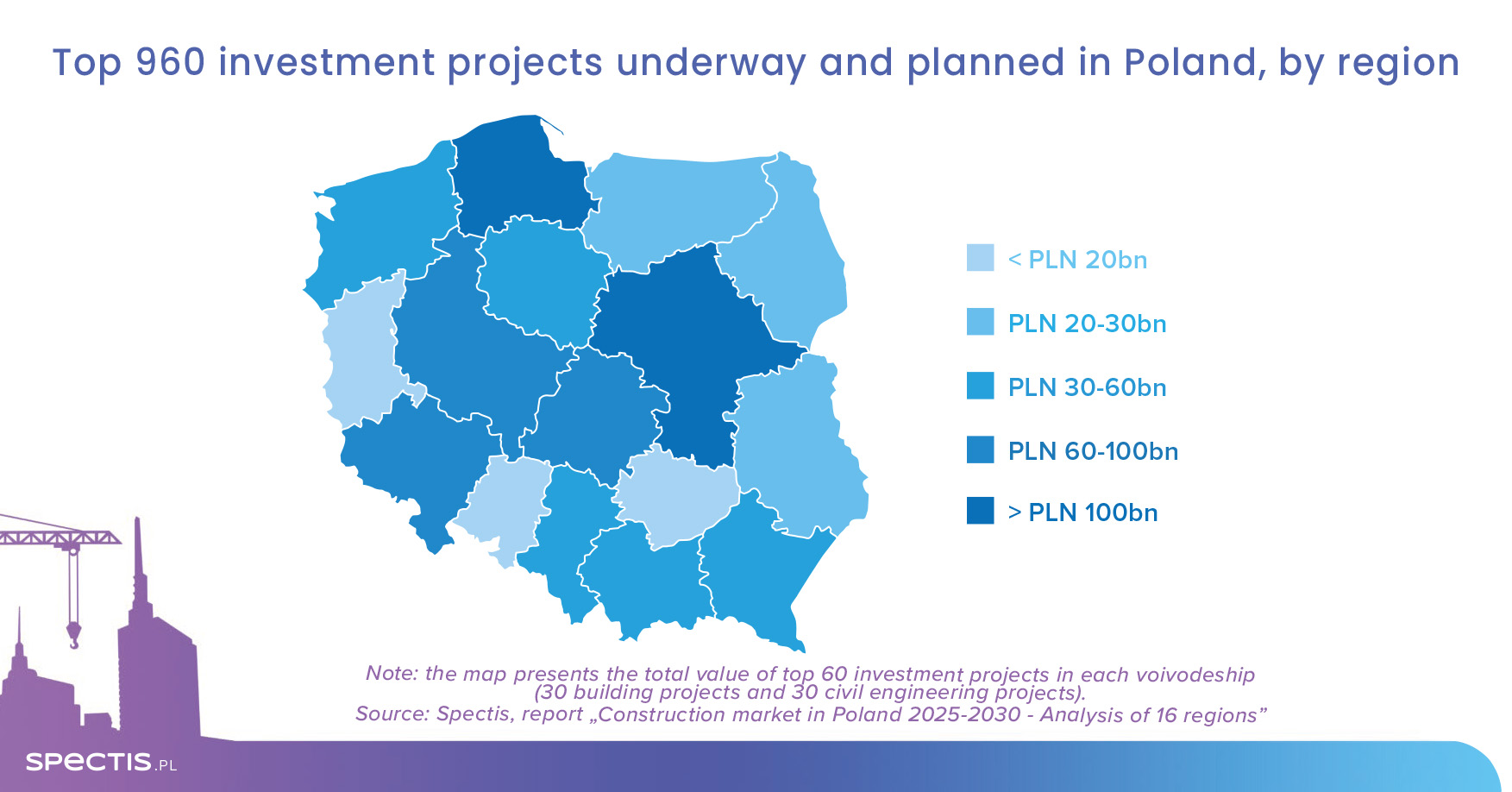

According to the Spectis report titled "Construction market in Poland 2025-2030 - analysis of 16 regions", the total value of the 960 largest ongoing and planned projects across Poland’s 16 regions is estimated at PLN 910bn, up from PLN 880bn a year earlier.

For the purpose of the report, we analysed nearly a thousand projects with the greatest potential to influence the future performance of local construction markets. In each voivodeship, we reviewed the 60 most important investments (30 in building construction and 30 in civil engineering). The combined value of flagship projects currently under construction stands at PLN 165bn (compared to PLN 152bn a year ago), while those in tendering, planning, or conceptual phases amount to PLN 745bn (up from PLN 730bn).

The average value of an analysed project is PLN 950m, including PLN 470m for buildings and PLN 1.43bn for infrastructure projects. In the engineering segment, this high average is driven by several mega-projects worth tens of billions of zlotys.

Which Polish regions attract the most construction investment?

Investment plans indicate that the Pomorskie and Mazowieckie voivodeship lead in terms of total project value. In both regions, the 60 largest investments exceed PLN 100bn in value.

Next in line are the provinces of Wielkopolskie, Dolnoslaskie, and Lodzkie, each with a total project value exceeding PLN 60bn. The investment appeal of these regions has been boosted by the government’s decision to construct the High-Speed Rail "Y" line, with a combined value (including the Mazowieckie section) exceeding PLN 80bn.

Poland's top investments and forecasts by province - 2025 ranking

-

Pomorskie leads the way, powered by nuclear and offshore sectors

In the Pomorskie region, key growth segments in the coming years will include energy and industrial construction (highlighted by the nuclear power plant project), hydrotechnical (port infrastructure), and rail and road investments - many supporting the future nuclear hub. Offshore development will also play a significant role in the regional investment mix.

In the building segment, residential development projects will dominate, not only in the Tricity area but also in smaller cities across the region.

Doki Living - a residential complex under construction in Gdansk’s Mlode Miasto district.

Source: Euro Styl -

Mazowieckie - from commercial developments to high-speed rail toward CPK

In the Mazowieckie region, major infrastructure projects are concentrated in energy and industrial construction (including the Orlen New Chemistry project, formerly Olefins III), railway (the Mazowieckie section of the High-Speed Rail line and Metro Line III), as well as roads and bridge/tunnel projects.

In building construction, the biggest projects are related to transport and communication facilities (notably the Central Communication Hub), office and public buildings, and large residential developments (e.g. F.S.O. Park).

F.S.O. Park - a planned mixed-use development on the site of the former FSO plant in Warsaw’s Zeran district.

Source: Okam -

Wielkopolskie - High-speed rail, but no nuclear?

The investment outlook for Wielkopolskie has improved significantly thanks to the government's decision to build the High-Speed Rail line. We estimate the voivodeship may receive over PLN 25bn from the entire HSR "Y" project. This is particularly crucial given the uncertain prospects of Wielkopolskie becoming the second nuclear plant location.

In building construction, the key areas will remain multi-family housing, industrial and warehouse facilities, and public buildings.

Planned new headquarters of the Musical Theatre in Poznan

Source: Teatr Muzyczny w Poznaniu -

Dolnoslaskie - production, logistics, and housing boosted by HSR

A key long-term project supporting construction in the region is the Dolnoslaskie section of the High-Speed Rail line, valued at over PLN 6bn. In the near term, regional infrastructure growth will be driven by road construction (A4, S5, S8 routes) and energy infrastructure.

In building construction, industrial and logistics facilities along with multi-family housing will be the dominant investment categories.

-

Lodzkie - benefitting from its central location

Like Mazowieckie, Wielkopolskie, and Dolnoslaskie, the Lodzkie region will be one of the major beneficiaries of the HSR "Y" line over the coming years - it may receive up to PLN 30bn from the entire project pool. Other key infrastructure projects in the region will include railway construction as well as power infrastructure.

In building construction, logistics facilities will remain a strong segment (including planned expansion of Loogic Park Radomsko and P3 Piotrkow), alongside further residential developments across the Lodz metropolitan area.

Planned high-speed rail network in Poland - the so-called “Y” line -

Malopolskie - large infrastructure projects under question

The top infrastructure projects planned in Malopolskie include ambitious multi-billion ventures like the Krakow metro, but many of these remain uncertain in terms of execution. We estimate the total value of six such projects at PLN 25bn.

The building segment looks more stable and functionally diversified. The largest building projects in Krakow under preparation or construction include the Essa Kliny housing estate, the 7R Hub tech and production complex, and the Tischnera Green Park mixed-use development.

-

Slaskie - declining importance of energy construction

Poland’s shift toward northern energy hubs has significantly reduced Slaskie’s role in energy construction. As a result, the region's infrastructure sector will focus on roads (especially the S11 expressway and various bypasses) and numerous railway projects across the voivodeship.

Key investments in building construction include large industrial and logistics projects (such as a metal recovery facility by Elemental Battery Metals and the H2Silesia green hydrogen plant by Polenergia and ARP), transport and communication facilities, and multi-family housing.

Planned new passenger terminal at Katowice Airport in Pyrzowice

Source: Katowice Airport -

Kujawsko-Pomorskie - hydrotechnical mega-projects remain uncertain

Unlike many other regions, the largest planned projects in Kujawsko-Pomorskie - such as a dam and hydro power plant on the Vistula River - still face major uncertainty.

The main building investments in the coming years will be public utility buildings (e.g. the expansion and modernisation of the Oncology Centre) and multi-family housing.

-

Zachodniopomorskie - growing focus on renewable energy infrastructure

Positive momentum in infrastructure construction in Zachodniopomorskie will rely heavily on major hydrotechnical and road investments. Additionally, a growing number of significant projects are linked to the energy sector. A major energy storage facility is under construction in Nowy Czarnow near Szczecin, while the world's largest offshore wind turbine tower factory by Windar Polska is being built in Szczecin.

Offshore wind turbine tower factory under construction in Szczecin

Source: Industria -

Podkarpackie - S19 and investment cluster around Rzeszow

In the coming years, Podkarpackie will see continued efforts to complete the national expressway network (new sections of the S19 route, and later the S74 route), along with the construction of spectacular viaducts and tunnels.

The performance of the building segment will depend largely on the implementation of public utility buildings, though some (e.g. the University Hospital in Swilcza) remain uncertain. The region will also see strong activity in residential development, supported by moderately optimistic demographic forecasts for Rzeszow.

-

Podlaskie - roads, rail, and military projects to drive growth

The key sectors in Podlaskie will include road investments (additional sections of the S19 expressway) and rail modernisation (Rail Baltica / line E75). A major catalyst will also be the PLN 10bn Eastern Shield - Poland’s largest border defense infrastructure project since 1945. Completion of this programme by 2028 is expected to result in numerous mid-sized contracts for local construction firms.

The building segment will be driven by projects in Bialystok, primarily multi-family housing and healthcare facilities.

-

Lubelskie - continued development of transport and logistics infrastructure

Lublin province is expected to see strong activity in railway projects (e.g. the Malaszewicze Reloading Area and several other projects worth hundreds of millions of zlotys) and road construction (new sections of the S12, S17, and S19 expressways).

However, the outlook for large-scale building projects in the region remains modest compared to other provinces at a similar economic development level.

-

Warminsko-Mazurskie - focus on road, rail, and tourism infrastructure

Construction activity in Warminsko-Mazurskie will focus primarily on road (S16 expressway and bypasses) and rail infrastructure (modernisation of the E75 line), with some support from energy investments.

The dominant segment in building construction will be mid-sized residential development projects, complemented by industrial, hospitality, and public utility buildings.

-

Lubuskie - border location key for logistics

In Lubuskie, the leading infrastructure sectors include energy and industrial (e.g. numerous wind and PV farms) and road construction (mainly national and regional roads).

The voivodeship stands out for its dominance of warehouse construction among planned major building projects. Its proximity to the German border and strong road infrastructure make it a strategic location for logistics developers. Despite the current slowdown in warehouse development, several projects are expected to move forward in the coming years.

-

Opolskie - location near A4 motorway attracts industrial projects

Key infrastructure investments in Opolskie will include railway and road projects (e.g. S11 expressway).

In building construction, industrial and warehouse buildings dominate. The largest project under way is a lithium-ion battery component factory (investors: Umicore Autocat Poland and PowerCO).

-

Swietokrzyskie - heading for a road construction mini-boom?

The most important project in the region is the construction of the S74 expressway, with its final sections planned for completion by 2030.

In building construction, key segments will include multi-family housing and public utility buildings. The largest planned residential project is Nowy Czarnow (investors: Karolkowa Investment, Condite, BC&O Polska), while the biggest public project is the expansion of the Swietokrzyskie Oncology Centre.

The future of regional construction markets - conclusions and recommendations

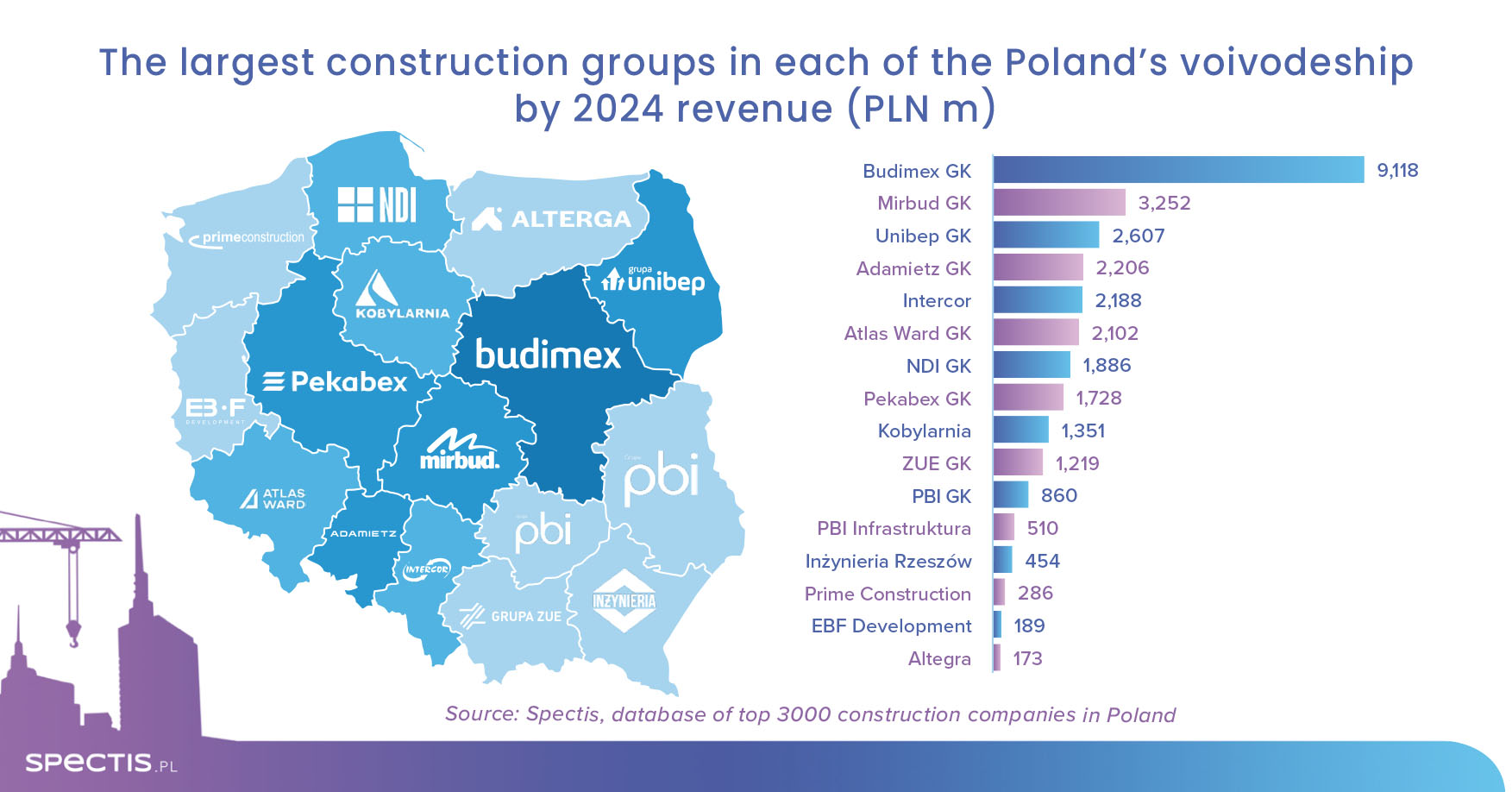

A carefully selected set of 960 top investment projects - with investor names, contractors, project values, and timelines - is presented in detail in our 200+ page report. The publication is accompanied by a database with key statistics and forecasts (including macroeconomic data, demographics, building permits, construction output, and projected housing completions).

Nearly 1,000 major projects paint a compelling picture of Poland’s long-term regional investment potential - aligned to each region’s economic scale. But as history shows, some projects may face delays, remain in planning stages, or be replaced by alternatives. That’s why for those who want to track project progress and stay ahead of the curve, we offer our Excel-based database of the top 3,000 construction projects, updated quarterly.

To learn more or download a sample report, visit our store: