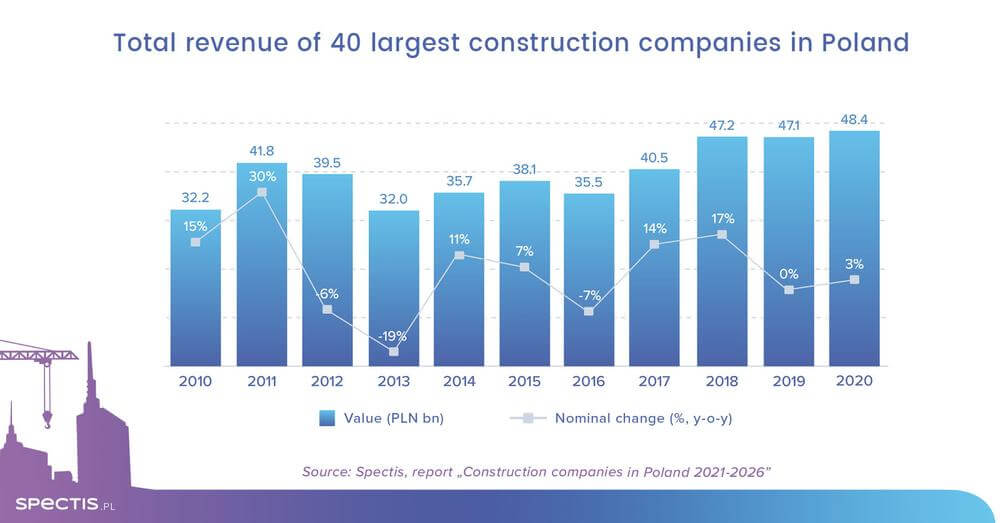

Total revenue reported by 40 largest construction companies operating in Poland levelled off at PLN 47bn-48bn in 2018-2020. Given the fact that construction costs had increased in the recent years, the companies’ work volume actually shrank. 2021 is poised to see a slight nominal hike in revenue posted by the largest construction enterprises. For these companies to continue to thrive, it is necessary that EU funding for Poland (National Recovery Scheme) and a cohesion policy budget for 2021-2027 are promptly approved.

The top 40 construction groups reported PLN 48.4bn in aggregate revenue in 2020, which represented 29% of total revenue posted by medium-sized construction firms and large construction companies, i.e. companies which employ more than nine workers, according to our latest report entitled “Construction companies in Poland 2021-2026”. Since the situation in the construction sector improved only slightly, construction companies are poised to report nominal growth of around 3% in 2021, which will be below the inflation rate for the sector. Whether construction companies can expect their revenue to grow rapidly in the future is conditional on when the new investment package co-funded by the EU can be really launched.

The Polish construction sector is still a highly-fragmented industry, with consolidation processes moving at a slow pace. Accordingly, the top five construction groups – Budimex, Strabag, Porr, Erbud, and Unibep – account for 8.2% of the entire construction sector’s value in terms of output, and they also represent 12.2% of revenue reported by construction companies that employ more than nine members of staff.

Financial results construction contracting companies have posted in recent years show that the construction industry remains largely unpredictable, and it is typified by a volatile number of large-scale orders from one year to another. A fact that should be noted here is that a vast majority of the major companies are specialised in a specific type of construction activity, e.g. industrial and warehouse, power, railway, bridge or tunnel construction, which makes them highly vulnerable to changes in the market situation.

An in-depth analysis of several hundred ongoing construction contracts shows that only a handful of firms from among the largest construction companies have highly-diversified portfolios.

A Spectis review of active contracts being handled by major companies shows that Budimex, Porr, Strabag, Intercor, Gulermak, Mirbud, Polimex-Mostostal, and Mostostal Warszawa are the groups currently engaged in the highest value projects, mostly due to participation in large-scale road, railway and power contracts. Among companies specialised in non-residential construction, Warbud, Skanska, Budimex, Porr, and Strabag report the highest value of contracts currently underway. Unibep and Erbud are at the helm of the residential construction sector. They both are engaged in residential projects well over PLN 1bn each.

As it was the case in 2019, a condition to qualify for the top 40 construction companies in 2020 was revenue exceeding PLN 400m. In a broader perspective, it was enough to post revenue of over PLN 100m to be qualified in the top 250 construction firms in 2020.

Ask for free sample of the report

info@spectis.pl