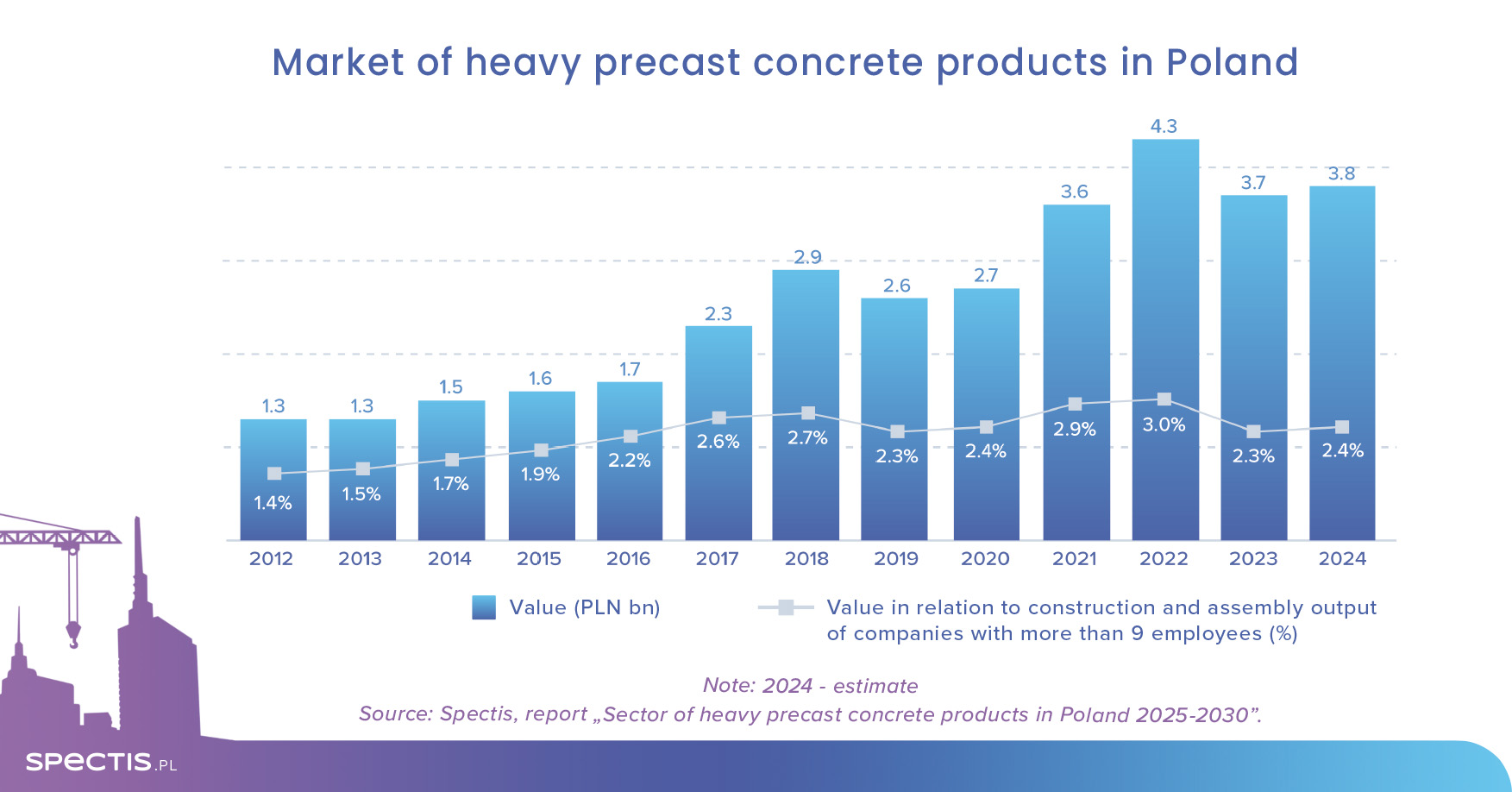

According to the report Sector of heavy precast concrete products in Poland, total revenue generated by the 50 largest prefab manufacturers reached PLN 5.8bn in 2023, with prefabricated components accounting for 63% of that figure. This translates into a market value of nearly PLN 3.7bn for the heavy concrete prefabrication segment in 2023, rising to approximately PLN 3.8bn in 2024. In the coming years, a growing share of prefabricated elements is expected to be allocated to civil engineering applications.

Based on preliminary data, we estimate that the value of the prefabrication market increased by approximately 4% in nominal terms in 2024, reaching around PLN 3.8bn. During the same period, the share of prefabricated components in the construction and assembly output of companies with more than nine employees stood at 2.4%, marking a slight increase from 2.3% in 2023. However, this still falls short of the record 3% share achieved in 2022, which was an exceptionally favorable year for the prefabrication sector.

The lower market values recorded in 2023-2024 were primarily driven by two factors: reduced order volumes and a decline in average prices of prefabricated components. The drop in prices was made possible by falling steel prices - steel being the main cost component in the production of concrete precast elements.

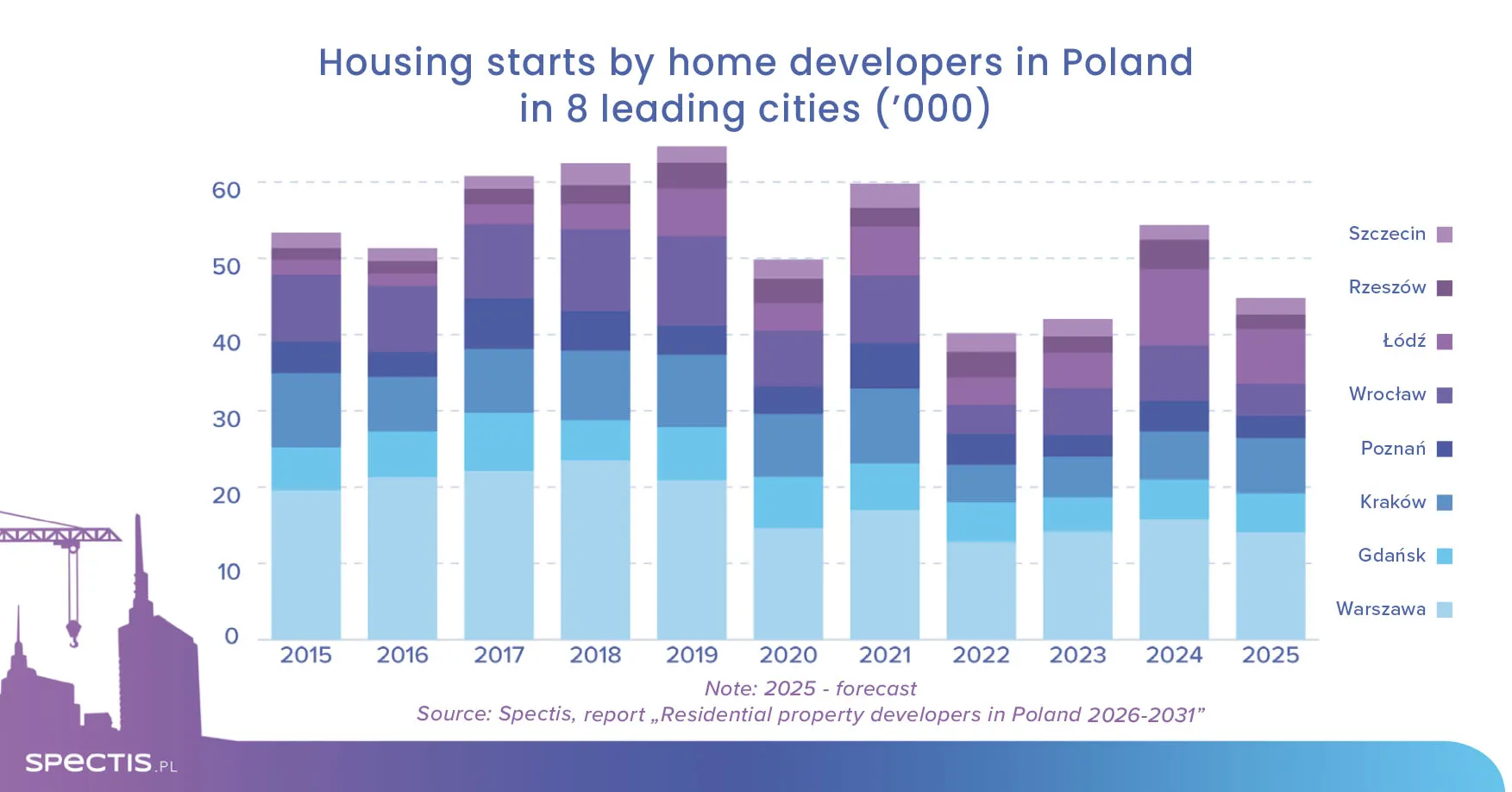

According to forecasts for 2025, the market is expected to grow at a faster pace, with its value projected to exceed PLN 4bn. This growth will be largely driven by a recovery in the residential and civil engineering construction segments. Continued growth is also anticipated in 2026, when a new wave of construction investments is expected to materialize.

Structural components as the backbone of precast construction in Poland

The largest segment of the heavy precast market continues to be structural components used in building construction - primarily foundation footings and sills, columns, beams, girders, and staircases. However, the share of this segment has slightly declined due to a slowdown in the industrial and warehouse construction market.

The second-largest segment consists of floor slabs and balconies, used in both residential and non-residential construction.

The third-largest segment is prestressed concrete railway sleepers.

Fourth place goes to precast wall panels for non-residential buildings - a segment growing in importance thanks to the rise of modular construction.

In addition to these core segments, there are several niche specialisations often served by individual manufacturers. These include modular bathrooms, foundation piles, columns, towers and poles, as well as precast products for the agricultural sector. The market is further complemented by loading docks, bridge beams, railway and platform slabs, road and tram slabs, retaining walls, and noise barriers.

Growing potential of precast for civil engineering

In the years ahead, the civil engineering segment of the precast market is expected to grow in importance. This segment includes products such as prestressed concrete railway sleepers, railway panels and walls, bridge beams, road and tram slabs, foundation piles, utility poles and towers, and retaining walls.

After four years of decline, the civil engineering segment regained momentum in 2023 - 2024 as non-residential building construction weakened.

Since most of the demand for civil engineering prefabrication is driven by the railway sector, the long-term outlook for this segment remains positive. A key development will be the implementation of the railway component of the Central Communication Port. A government decision made in June 2024 to launch the High-Speed Rail initiative led to a major update of the Database of top 3000 major construction projects. As a result, the total value of 270 railway and tramway projects rose to PLN 200bn, up from PLN 130bn in previous years.

In the longer term, a clear increase in demand is also expected for precast components used in the energy sector, as Poland undergoes energy transition.

Stable role of precast in residential construction

According to official statistics, the share of fully prefabricated housing - i.e., multi-family buildings constructed using precast wall systems - remains low, at under 2%. However, the actual share may be slightly higher, as construction technologies are often reported inconsistently, particularly in projects involving a mix of methods.

Compared to Scandinavian countries or Germany - where prefabrication plays a much more prominent role - Poland shows considerable growth potential in this segment. A key challenge for precast manufacturers remains convincing investors - municipalities, developers, and individual customers - of the advantages of this technology. For now, prefabrication plays a complementary role to traditional construction methods, especially in the form of precast staircases, floor slabs, and balconies.

To learn more or download a report sample, visit the store:

Methodology note:

For the purposes of this report, the heavy precast segment is defined as the production of reinforced and prestressed concrete components carried out by specialised precast manufacturing plants. The products analysed in the report fall into two main categories, with each category containing numerous sub-segments:

- Structural precast components primarily used in non-residential construction (foundations, columns, beams, floor slabs, walls, staircases, modular bathrooms, loading docks)

- Civil engineering precast components (bridge beams, foundation piles, road and tram slabs, railway sleepers, retaining walls, noise barriers, tunnel segments, as well as lighting and power poles and towers).